Over the past decade major infrastructure projects, such as transmission line projects seeking to carry wind and solar power from its source to where it is needed most has been most difficult. But the case for new multistate transmission lines has never been clearer. A growing number of states and utilities have set 100%-clean-energy goals, but they have plans to generate this clean energy close to the communities and homes where it is needed. Therefore, the gap between the transmission network’s capability to deliver this needed power is growing – even wider.

Within each state, congestion costs, instances of negative grid pricing, and other effects are demonstrating just how much these new transmission projects are needed. But these projects can be derailed at many points along the way, since the process – to this point – is an arduous decade-long battle from conception to completion.

These transmission projects require regulatory approval from the state’s the transmission lines may cross. To obtain approval from the regulatory agencies can be very difficult – due to public opposition from environmental groups and communities worried about their impact, or in some cases, landowners who refuse to allow passage of the lines through their properties. These kinds of issues, have from time to time, led to several high-profile project failures.

A tally of some of the canceled projects includes Eversource’s Northern Pass Project in the Northeast as well as the transmission lines that were part of the first, larger version of American Electric Power’s Wind Catcher Project (today a smaller version is moving ahead without the addition of new transmission lines). One developer, Clean Line Energy, had to close its doors and canceled or sell off multiple projects, despite the backing from utilities, state, and federal agencies.

All the same, transmission developers have not given up. A surprisingly large number of major projects are still moving ahead, each with the opportunity to unlock big amounts of renewable energy and bring it to where it’s needed most.

Transmission developers have long said that if only a few big renewable-linked projects could get built, the path would open to others once the benefits were made manifest. That theory was largely left untested in the 2010s.

Here are seven still very-much-alive projects that could prove it out in the decade ahead.

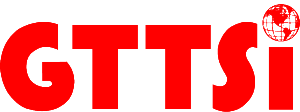

| Gateway West is a 1,150-mile, $2.6 billion project, first proposed in 2007, and just one of several major transmission corridors designed to carry power from Wyoming’s burgeoning fleet of wind farms to the populous West Coast markets. It is actively being built with hopes of completion by the end of 2020, although the project still awaits state and local permits to reach the finish line. |  |

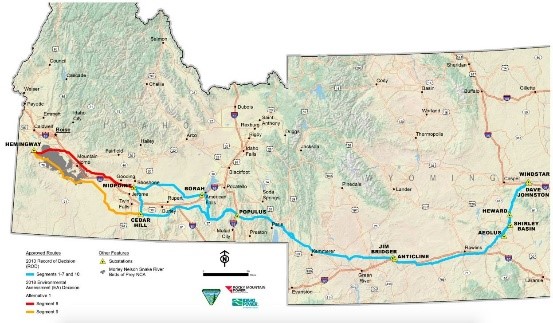

| TransWest Express is another project meant to carry wind power from Wyoming to faraway markets, such as California and Arizona. This $3 billion project envisions a 730-mile corridor capable of carrying up to 3 gigawatts of power from southwestern Wyoming through Colorado and Utah to Nevada’s Hoover Dam, which then connects them to the clean-energy hungry grids of California and Arizona. |

| SunZia is a $2 billion transmission project which faces an uncertain future, but its sheer size and profile secured its spot on this list. This is one of several big transmission projects geared to bring renewable energy from the Desert Southwest to markets farther west. When completed it will have a capacity of 3,000 megawatts and would be a critical link for Pattern Energy’s 2,200-megawatt Corona Wind Project, already approved by New Mexico regulators in 2018. This 514-mile transmission project is jointly sponsored by Southwestern Power Group, Shell WindEnergy Inc. and Tucson Electric Power. |  |

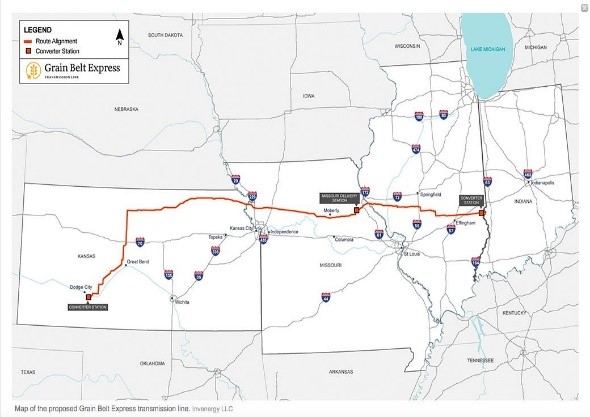

| Grain Belt Express is a former Clean Line Express project, when completed it will carry up to 4,000 megawatts of wind power in western Kansas to its endpoint in Indiana, part of the 11-state grid system, PJM. But this 780-mile, $2.3 billion project has had a tough time, gaining approval of regulators and landowners in the four states it crosses. After initially being denied by Missouri regulators, Grain Belt Express won a court battle to allow a rehearing, only to have another court in Illinois overturn the approval of Illinois regulators of the project weeks later — underscoring the whack-a-mole reality of these multistate projects. |

| SOO Green HVDC Link is a 349-mile transmission project that would harness wind resources across Iowa to northern Illinois, connecting the wind-rich grid operator MISO to the mid-Atlantic grid operator PJM. If that sounds familiar, SOO Green HVDC Link is designed to avoid problems encountered by the Grain Belt Express and other above-ground transmission line projects, with a plan to bury its high-voltage direct-current cables underground and use, for the most part, existing rights of way already owned by the railroad companies. |  |

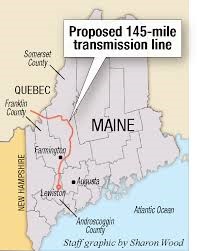

| New England Clean Energy Connect is a transmission project, which would carry up to 1,200 megawatts of Canadian hydropower from Hydro Québec into Massachusetts. In 2018, Avangrid subsidiary Central Maine Power (CMP) won a bid to develop the $1 billion, 145-mile project — a replacement for the failed Northern Pass Transmission project. In January 2020, Maine’s Land Use Planning Commission approved the project, but opponents, who object to CMP’s plan to cut through 53 miles of forest, gathered enough signatures in March to place a referendum on the November 2020 ballot. |

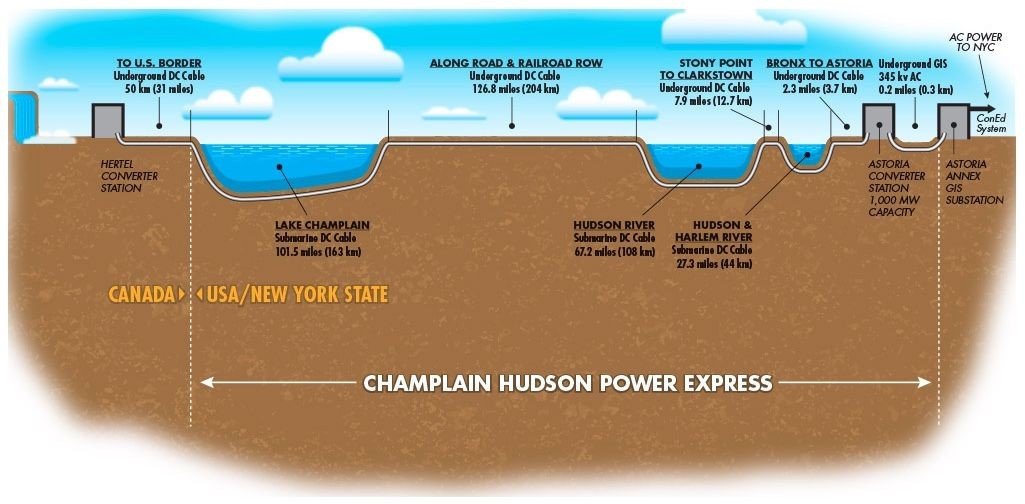

| Champion Hudson Power Express is a transmission project that TDI New England is developing. It too, is a HVDC line, designed for 1,000-megawatt capacity, that would run 330 miles from the Canadian border to New York City. It too, would have its high-voltage direct-current cables buried underground along railroad and roadway right of ways, and under the Hudson River. This $2.2 billion project was originally approved in 2013, but now a few route changes will require new approval by New York regulators. |  |