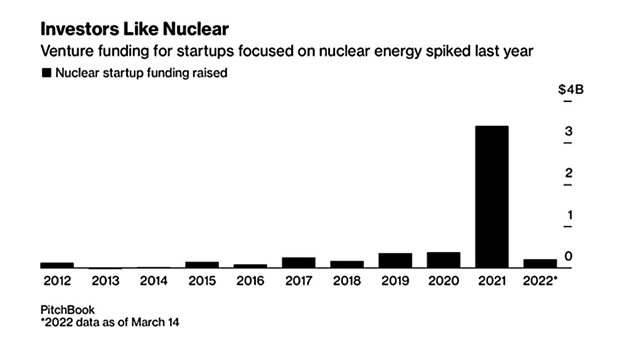

The trend of big-tech billionaires of Silicon Valley investing in next-generation nuclear energy startup companies continues. Last year, venture investors reached a record $3.4 billion into nuclear start-ups — more than in every year over the past decade combined, according to research firm PitchBook.

That number reflects very early-stage start-ups as well as more mature companies like Commonwealth Fusion Systems and Helion Energy Inc., both of which raised funding rounds of $500 million or more in 2021.

As concerns over climate change grow, nuclear power’s advantages have become clearer. Like solar, nuclear power has no carbon emissions; unlike solar, it can reliably produce energy 24 hours a day. It’s also a path toward energy independence.

Just this week, NuScale Power, an industry-leader in advanced nuclear small modular reactor technology secured a $10 million investment from SailingStone Capital providing another boost to its pending Spring Valley merger. This transaction increases the total private investment in public equity up to $221 million for this merger.