The Inflation Reduction Act of 2022 (IRA), which became law on August 16, 2022, is the most significant climate legislation in U.S. history. It directs new federal spending toward reducing carbon emissions, lowering healthcare costs, funding the Internal Revenue Service (IRS), and improving taxpayer compliance over the next ten years. The estimated cost associated with reducing carbon emissions is $760.7 billion. Nearly $394 billion of the $760 billion is for climate efforts with the majority in the form of tax credits. Corporations are the biggest recipients, with an estimated $216 billion worth of tax credits, $43 billion in tax incentives for consumers, $82 billion in grants, $40 billion in loans, and $13 billion in federal operations.

Now that the IRA is history, we see statements like this being expressed in the mainstream media – “replacing U.S. coal plants with solar and wind is cheaper than running them.” “The Inflation Reduction Act has made this local replacement and reinvestment scenario so economic and so much cheaper than coal,” said Michelle Solomon, a policy analyst at Energy Innovation and the lead author of a report published by San Francisco-based climate think tank Energy Innovation. “It really creates a big opportunity to diversify the economics in coal communities.”

The law includes a 10% tax credit for so-called “energy communities,” including areas with retired coal plants, to transition to clean energy infrastructure.

The report authors calculated the costs of operating each of 210 coal plants in the United States, considering fuel and operations as well as future maintenance expenditures. They then compared those numbers to costs associated with installing and operating new wind and solar projects nearby. In all but one case, the renewable project required less cash.

However, the reduced costs for wind and solar is only possible due to the passage of the IRA.

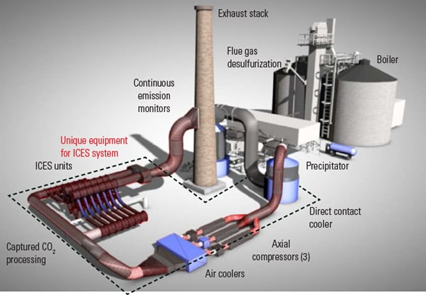

Just imagine if that same amount of money was spent to find a way to make our coal plants net zero emissions via carbon capture or with some other technological advancement. $760.7 billion invested in these 210 coal plants equates to $3.6 billion per coal plant. Just with our current technology of carbon capture 60 million tons could be stored per coal plant based on the article “Total cost of carbon capture and storage implemented at a regional scale: northeastern and midwestern United States” at $52-60 per ton. https://royalsocietypublishing.org/doi/10.1098/rsfs.2019.0065 Since the average coal plant burns 14,000 tons per day that would equate to 11.7 years. This timeframe is greater than the IRA timeframe and we have an abundance of coal already available.

Consider the costs when the IRA incentives are exhausted for wind and solar. Based on the results in Europe where incentives no longer exist, the cost of electricity is at least twice current prices and once battery energy storage or some other means of energy storage is added it will cost even more. And energy storage is a must if we truly want to eliminate all fossil fuels from our energy mix.